What is that Level01 ?

Level01 is a peer to peer (P2P) derivative exchange that allows investors to trade option contracts directly with each other, without requiring intermediaries or brokers.

Level01 can combine Distributed Ledger (DLT) Technology for transparent and automatic transaction settlement on blockchain, with Artificial Intelligence (AI) analysis that provides dynamically fair value pricing to counterparties in trading, based on current & retrospective market data.

This platform intends to effectively remove all frictional forms in the user experience existing in conventional exchanges, such as deposits / withdrawals, double-level identity verification, and wallet security issues; allowing investors to fully focus on trading activities.

The Level01 platform facilitates transparency & equity, and is designed to provide the most fair, efficient, and equitable trading areas for retail & commercial investors.

Key Features at Level01

- Simple / Advanced Trading

- Automated Blockchain Settlement

- Transparent Marekt Data

- Market Asset Variety

- Fairsensetm Artificial Intelligence

- Trade Room Hosting

- Instant Deposit / Withdrawals

- Hotswap Capability Token Wallet

Simple, effective trading experience with advanced features for experienced users.

Automated, transparent trade settlement handled by blockchain smart contracts.

Fully transparent market data verified by 3rd party oracle service providers.

Trade both traditional & cryptocurrency market assets for more opportunities.

AI analytics fair price discovery enabling better quality trade matching experience.

LVX token staking mechanism enables trade room hosting to earn commissions.

Trader has full control over funds and deposits/withdrawals are done instantly.

Instantly change platform native token to Bitcoin or Ethereum for more liquidity.

Product

Level01 APP for everyone to trade

The Level01 App enables investors to trade derivatives freely from a multitude of assets, ranging from Forex, Cryptocurrencies, Commodities, Stocks and Indices, investor opportunities are boundless.

High speed live tick by tick data is streamed and displayed in fully informative, interactive charts; with a multitude of analysis and charting tools for more advanced users.

The App features a proprietary user interface that makes it simple and efficient for conducting peer to peer trading with other investors in the Level01 Exchange.

The App integrates seamlessly with the Ethereum blockchain, enabling investors to fund contracts and trading transactions while maintaining full control over their wallet assets.

How Trading Works

Level01’s mobile/web app enables investors to interact directly with each other for trading. Investors can trade risk or hedge positions by issuing options contracts for counterparties to match with on the Level01 platform.

- Investors select asset category they are interested in, such as Forex or Cryptocurrency, and selects asset market to trade in, such as USD/EUR or Ethereum.

- Investors trade by issuing option contracts into markets: by defining contract parameters ‘Expiry’, ‘Strike Price’ & ‘Position’, and contract Total Value or selecting an existing option contract to act as matching counterparty.

- When an option contract is matched with a counterparty, all parameters are sent to the Level01 smart contract on the blockchain. The smart contract receives permission from both parties to handle token funds and performs trade settlement upon option contract maturity (expiry).

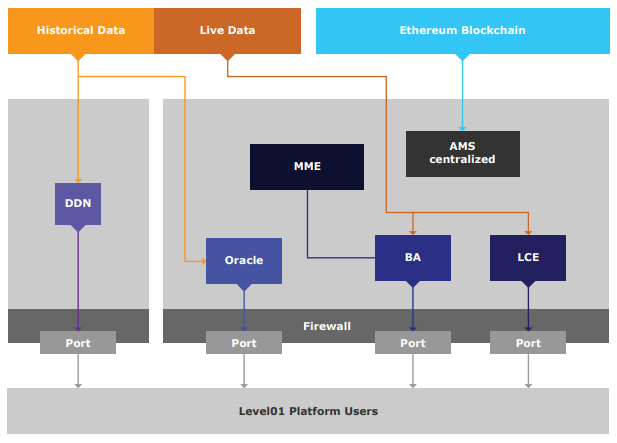

Platform Architecture

The Level01 Trading Platform is modularly designed into several distinct modules that enable ease of scalability, development updates, debugging and zero downtime maintenance. These are the off-chain server processes of the trading & exchange engine, and the on-chain transaction settlement LIST smart contract on the blockchain interacting with real-time and historical data feeds to form an efficient, transparent, hybrid platform.

All processes are load-balanced and are scalable without the need to interrupt the system in run-time. The Architecture is defined to support inter-server distribution to achieve minimum response time by allocating local servers in different regions in the future.

Trading Engine

The Trading Engine is composed of the following components :

- LCE – Live Contract Engine, is a websocket service which handles all subscription to live option contracts on the platform. The subscribed clients will receive immediate information update on the contract.

- BA – Business API, a REST service which serves the clients the entities of the system.

- AMS – Account Monitoring Service, monitors and keeps track of transaction statuses and querying blockchain wallet balances. It will also inform the system of wallets which are underfunded to delist the relevant contracts.

- DDN – Data Distribution Node, retrieves historical and live data from the market data provider, and distributes it to client applications.

- MME – Master Matching Engine, is the centralized process that handles off-chain matching of trading contracts. Once off-chain matching is performed, it is passed to the LIST Smart Contract for on-chain handling.

The Trading Engine performs all matching and fulfilment services for the users. It receives all trading input parameters from the client application, and dynamically organizes, processes and outputs the data in real-time to be viewed and interacted on.

The Trading Engine dynamically displays options contracts according to user parameters, and pricing derived from the FairSense™ algorithm (described in the next chapter). The algorithm incentivizes a counterparty to match with an open contract by dynamically balancing the cost of matching according to the existing situation and current risk.

Upon a trade matching, the Trading Engine performs data checks with the AMS, such as time stamp verification and funds availability before delivering the trade data to the Transaction Settlement System.

Market Data Feed

The Level01 platform’s real-time and historical market data feed is provided by Thomson Reuters, a global multinational mass media and information company. The Level01 platform connects and accesses the data feeds through Thomson Reuters API’s, then processes and redistributes the data for :

- Charting of both historical and real-time market data in the client application

- Back end server algorithms to calculate FairSense™ analytics

During the settlement process, the platform also accesses Thomson Reuter’s data feed through a 3rd party oracle service to verify the authenticity of the data during payoff calculations and contract settlement.

Token Level01

The Level01 Exchange (LVX) token is an ERC20 token on the Ethereum blockchain, and functions as a medium of exchange and store of value within the Level01 financial ecosystem.

The LVX token provides the means to transparent and fair settlement on the blockchain, because it can be handled/automated by smart contracts and programmatically disbursed to trade winners as trading profits.

LVX tokens can also be ‘staked’ by investors to host trading rooms where group trading events are held, and investors earn traderoom hosting commissions. The staked tokens are reimbursed by the smart contract after a staking duration.

- Store of Value

- Medium of Medium of Exchange

- Incentivized Staking

- Limited Supply

The LVX token provides use as a store of value and blockchain asset within the Level01 financial ecosystem.

The LVX token facilitates transactions between investors as a standard operating exchange medium within Level01.

Integrated token staking functionality promotes variation in user base participation and ecosystem network effect.

Predetermined fixed supply token promotes appreciation and increased demand from scarcity as user base grows. The token’s digital nature allows transparent & trustless interoperability with blockchain for automated settlement.

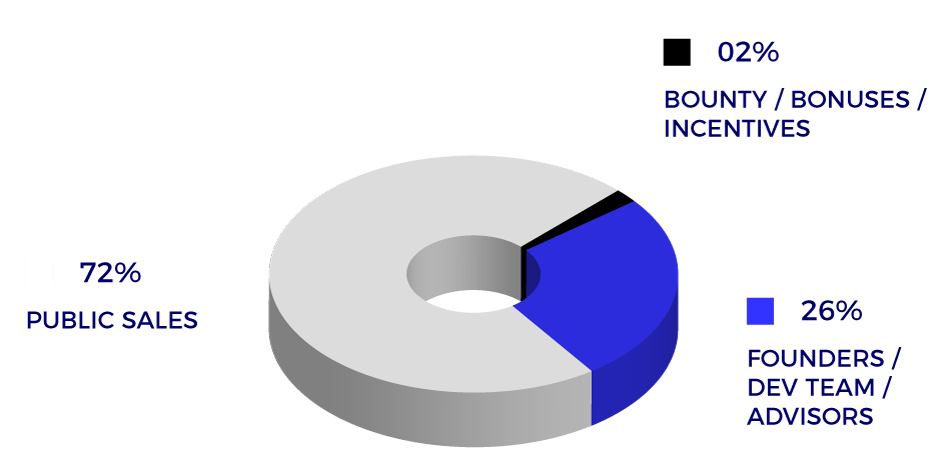

Detailed of Token Sale Information

- Name : Level01 Token

- Symbol : LVX

- The technology used : ERC20

- Type : Standard

- Total Tokens : 1,200,000,000 LVX

- Soft Cap : $ 15,000,000

- Hard Cap : $ 75,000,000

- Tokensale ends on September 23 UTC 00:00

- Minimum purchase is 2000 LVX tokens

- Maximum purchase is 800,000 LVX tokens

- Per user-verified account

- Tokens that have not been sold at the end of the sales token are destroyed

- LVX tokens are fixed and can not be created / mined

Token Distribution

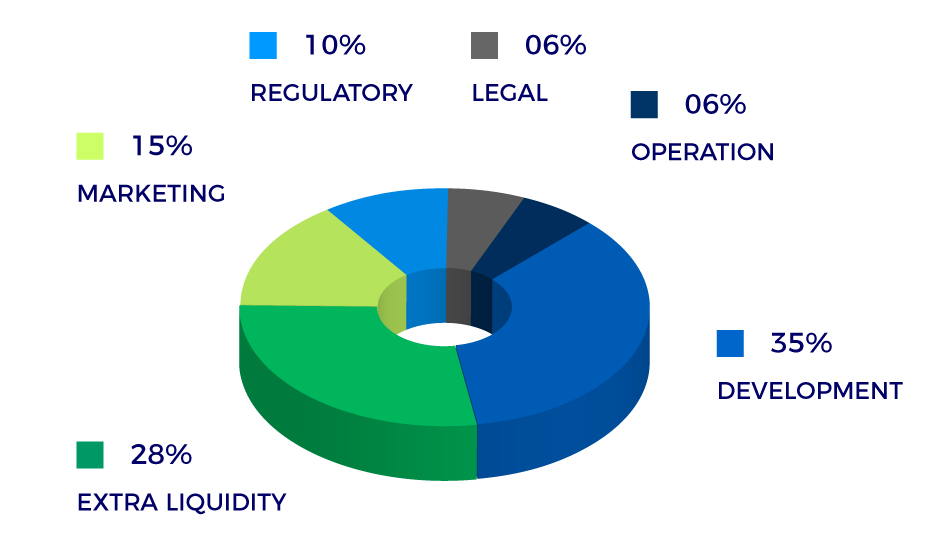

Fund of Allocation

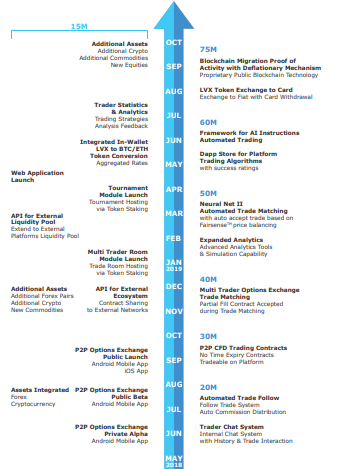

Roadmap

Core Team

Founder, CEO

Founder and director of public listed technology company in Australia, and inventor of its patented core technology. Experience growing a company from startup to public offering. Extensive know ledge in mobile hard/software product design and UI/UX technologies. Involved in machine learning.

Vice President Asia Pacific

Highly decorated with multiple titles & distinctions, expert corporate strategist and brand planning expert in Asia Pacific with more than 15 years of localization experience. Skilled in in strategic and corporate management, top-down design, financial investment, education & training.

Head Quant Developer

Key quantitative analyst consultant overseeing $25B AUM and lead in specification, design,implementation and management of most advanced pension hedging & absolute return solution at UK’s largest asset management Co.Professional in derivatives pricing, risk & trading.

Business Development

Senior consultant with over 15yrs in finance & banking industry. Specialist in commercial & investment banking processes including analysis, asset/project management, due diligence & under writing distribution for IPO’s. Experience in capital markets & investment management analytics.

Blockchain Consultant Developer

Experienced developer for various core blockchain based projects including OTC-interest rates swap trading platform and digital ledger based recruitment with document verification platform. Certified Solidity Smart Contract developer. MSc degree at Imperial College London with full distinction.

Partner, Chief Operations Officer

Extensive background in corporate operations for over 15 years. Highly skilled at maximizing the resources of an organization and recognise the best growth path for a company. Early partner of founder in Australian public listed company. Built, nurtured and led companies to over $125M in M&A.

Chief Marketing Officer

A pioneer in social media marketing and one of the early entrants in the digital marketing industry since 2009. His agency is also one of the earliest to embark on blockchain and crypto related marketing in South East Asia. He is ranked on Google as “Best Social Media Consultant in Malaysia”.

Chief Systems Architect

Professional software engineer & system architect. Experienced designing impactful high performance solutions. MSc Science & Computer Engineering. Led several worldwide projects successfully to pro- duction in various industries: finance, ERP & trading. Key backend system architect of Level01 platform.

Quantitative Analyst

Mathematician & data analyst focused on R&D in the financial services industry. Developed some of the most sophisticated credit risk modelling algorithms for banks in Latin America. Experience with researching & implementing business & financial analytics solutions. AI and neural networks tinkerer.

Partners and Associates

Information we can provide more about the Level01 project, you can visit our site below :

- Website : https://level01.io/

- Whitepaper : https://level01.io/wp-content/uploads/2018/06/level01_whitepaper_final1-2.pdf

- Facebook : https://www.facebook.com/level01platform

- Twitter : https://twitter.com/level01io

- Instagram : https://www.instagram.com/level01io/

- Telegram : http://www.t.me/level01ico

- ANN Thread : https://bitcointalk.org/index.php?topic=4499211.0

- Author (Beat Putih) ; https://bitcointalk.org/index.php?action=profile;u=1953434

Tidak ada komentar:

Posting Komentar