INTRODUCTION

Blockchain technology has been in our lives for almost 10 years. The way technology has come in this short time is truly incredible. As of today, Bitcoin alone has a market volume of $ 100 billion. As of the moment I write this article, the price is approaching $ 8,000. This technology, which permeates our lives very quickly, has also provided new business opportunities in many areas. And when this is the case, many business opportunities and opportunities come to our feet. In order to spend the cryptcurrency we earn, we attack the stock markets and branding. There are thousands of stock markets around now and we really have a lot of doubts about which one to choose. This is due to security problems. Because every year tens of millions of dollars worth of cryptocurrency is stolen. As this technology is new, it is still a blunt in taking security measures.

What is STO?

Security Token (STO): It is important to distinguish between Utility tokens and Security tokens before clearing the Security tokens. Utility tokens are also referred to as user tokens or application tokens, and are used to access a company’s product or service.

The distinctive feature of Utility tokens is that they are not designed for investment purposes. If properly configured, Utility tokens are not subject to securities laws. The ERC-20 tokens of the Ethereum platform are Service tokens.

Security tokens are supported by real assets such as stocks or commodities of a limited liability partnership. They are also subject to securities laws. Security token will create a radical change in the representation of company shares. In addition, there are intensive studies on the use of Security tokens in the real estate sector.

Companies use this as a way of offering part of their business to investors, in return for a short-term cash injection that can help them to realize their latest goals and plans. Investors can also be entitled to profits, dividends and interest rates.

Introducing Stellerro

Stellerro is the market leader in delivering an institutional grade, secure solution for the issuance, underwriting, financial distribution, and asset management of tokenized and digitized securities.

Stellerro has its own proprietary Security Token Offering (hereinafter, STO) technology and a fully customized onboarding platform, backed by legal compliant solutions for issuers, intermediaries and investors to issue, purchase and liquidize security tokens safely, with ease. Stellerro collaborates with family offices, venture capitals, investment banks, legal firms and high networth individuals, using a strict KYC, AML and Accreditation onboarding processes.

The go-to-market strategy is both Business to Business (B2B) (personal networks, conferences, events and introductions) and Business to Customer (B2C) using online multilingual distribution channels.

Stellerro’s solutions utilize blockchain technology tied with decades of experience from the traditional capital markets, creating a holistic, transparent, and secure digital security offerings platform to allow customers to Issue, structure, market and distribute Digital securities in a number of jurisdictions and supported regulations. Stellerro aim to bridge the gap between traditional capital markets and blockchain based tokenized digital assets.

Stellerro Growth Plan

The technological, financial and legal foundations of Stellerro have been finalized. The company’s next step is to launch its own security token offering as an initial move. Once Stellerro’s dedicated digital securities are launched and start to gain traction, we on the one hand will be ready to support a personalized digital asset management company to handle and realize the full potential of the seed investments. On the other hand, by using the knowledge and expertise garnered through the past successes, Stellerro will create a fully dedicated White-label model to implement in large scale investment firms, startups and many other businesses, enabling prompt and professional liquidation of these assets as with Stellerro’s own assets.

Solutions are already available for entrepreneurs from a wide range of sectors looking for fundraising via the blockchain, whether holistic or partial, from initial consulting, onboarding, compliance and issuance, all the way to auditing, including a full walkthrough if needed.

Stellerro complete holistic solution set for investments includes three tiers of growth:

- The basic tier - the STO “factory” - assists entrepreneurs to examine, plan and execute a full fundraising process from A to Z, including all the steps mentioned above.

- The middle tier incorporates funds, holdings, and venture capital holdings; it loops these entities to invest and take part in the existing STOs, and launch their own multi-tier alternative funds using the Stellerro model.

- The top tier and capstone is Stellerro’s Multi-chains & Conglomerate Collaborations. Once the first two tiers have developed strong roots, the biggest conglomerates will be tackled along with the a dedicated multi-fund offering, utilizing both traditional and alternative fundraising methods to benefit every part of the ecosystem.

What is the difference between Stellerro and Others?

In the world of digital securities, all the regulations can be coded into a smart contract and become immutable. By so doing we have an encapsulation of the regulations on the blockchain that cannot be changed. In other words, smart contracts are code-binding and guarantee that the contracts will bear out without a 3rd party enforcer. Stellerro enhances the logic, quality and security of smart contracts and performs tests on blockchain assets, liabilities, equity and smart contracts, thus establishing a firm foundation for accelerating companies’ adaptation of blockchain technology. The financial and legal audit process of Stellerro is carried out in three tiers: Compliance, Security, and Efficiency. During an audit, the following three aspects of a smart contract are examined:

- Security: Validating the integrity of the codes run on blockchain. Using its state-of-the-art cyber security tools and expertise, Stellerro investigates the smart contract code to detect potential breaches, known hacker attacks, potential fraud, and bad practices that may cause security threats.

- Functionality: The objective of a functionality audit is to provide an independent evaluation of software products, verifying that the configuration items' actual functionality and performance is consistent with the requirement specifications. Specifically the functionality audit is held prior to the smart contract delivery to verify that all the requirements specified in the smart contract settings have been met. A functionality test includes running in various scenarios and performing quality assurance, uncovering numerous issues such as blocked actions, bugs in processes and missing features.

- Efficiency: The final step examines the efficiency of transactions and the amount of calculations required to run a transaction. Smart contracts are very inefficient, namely consuming much “gas” (the fuel of the Ethereum network represented by Ether). If certain scenarios make the smart contract inefficient, Stellerro corrects them through its own proprietary coding patents, thus improving the

efficiency of the smart contract.

Increasing popularity of smart contract technology gives rise to new challenges for businesses and new risks in the audit process. Stellerro has the technological arsenal essential to validating the design and controlling the contract. With the help of highly skilled professionals who have the know-how of big data interpretation and bug fixes, new smart contracts are handled with top caution and profession.

CONLUSION

As blockchain technology evolves, the dynamics within itself change and evolve. ICOs are now replaced by IEO and STOs. As an investment instrument, STOs are definitely my priority. The facilities they offer are much more reliable than ICOs. And also the returns are much more realistic. The KYC / AML procedures they use are approved by the major regulatory authorities of the countries. In this way, the rate of return on your investments is quite high. For more information about Stellerro, please follow the links below.

ROADMAP

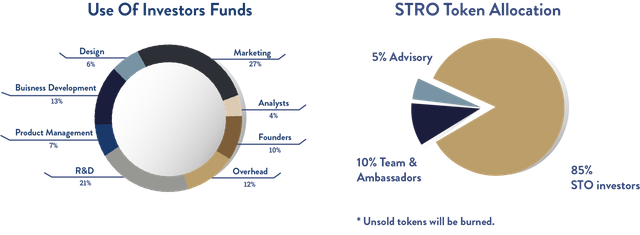

FUND ALLOCATION AND DISTRIBUTION

PARTNERS

Website: https://www.stellerro.com/

2-Pager: https://drive.google.com/file/d/1Fkru-bwP1n0eAEVJwJKiF0pJuyUI7u26/view

STO-Deck:https://drive.google.com/file/d/13vuc3B1gAP7VNbhZ8rfR_EUsv3NkWtZJ/view

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=5148631

Telegram: https://t.me/stellerro

Twitter: https://twitter.com/stellerro

Facebook: https://www.facebook.com/Stellerro

2-Pager: https://drive.google.com/file/d/1Fkru-bwP1n0eAEVJwJKiF0pJuyUI7u26/view

STO-Deck:https://drive.google.com/file/d/13vuc3B1gAP7VNbhZ8rfR_EUsv3NkWtZJ/view

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=5148631

Telegram: https://t.me/stellerro

Twitter: https://twitter.com/stellerro

Facebook: https://www.facebook.com/Stellerro

Author : Beat putih

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1953434

Tidak ada komentar:

Posting Komentar