Tranche

Tranche is a decentralized money convention that permits clients to make diverse danger profiles from DeFi income. Customarily, high-hazard obligation instruments are cut into more modest pieces, blended in with each other, and new resources, known as Collateral Debt Obligations (CDOs), are made. Tranche permits clients to do likewise for DeFi credits and resources.

Tranche is a decentralized convention for overseeing hazard and boosting returns. The convention incorporates with any premium gathering token, like Compound's cTokens and AAVE's aTokens, to make two new premium bearing instruments, one with a fixed-rate, Tranche A, and one with a variable rate, Tranche B. Tranche parts any yield-creating resource from the DeFi environment into two unending resources: a decent rate resource that allows you to deal with your danger, and a variable rate resource that amplifies your profits.

Tranche carries the idea of obligation status to decentralized money. By coordinating with interest bearing tokens (for example Build cTokens, AAVE aTokens, Yearn yTokens), and making an obligation cascade — Tranche makes a generally safe fixed-rate resource (Tranche A), and a high-hazard variable-rate resource (Tranche B). We'll get into what this implies in the areas underneath.

Loaning

Giving an advance is the most clear way of collaborating with the Tranche convention and create interest in stores. Credits are largely interminable, implying that they will keep on being open until the borrower returns the loaned sum. Higher interest credits pay a better yield for every square, and you can pull out interest whenever.

To loan on Tranche, find the credit that intrigues you as far as sum and financing cost. You'll begin gathering interest when you support the advance, and you can gather that interest at some random point on schedule.

Purchasing Tranche Tokens

For every resource on the Tranche convention, there is two Tranches, a proper rate, and a variable rate Tranche.

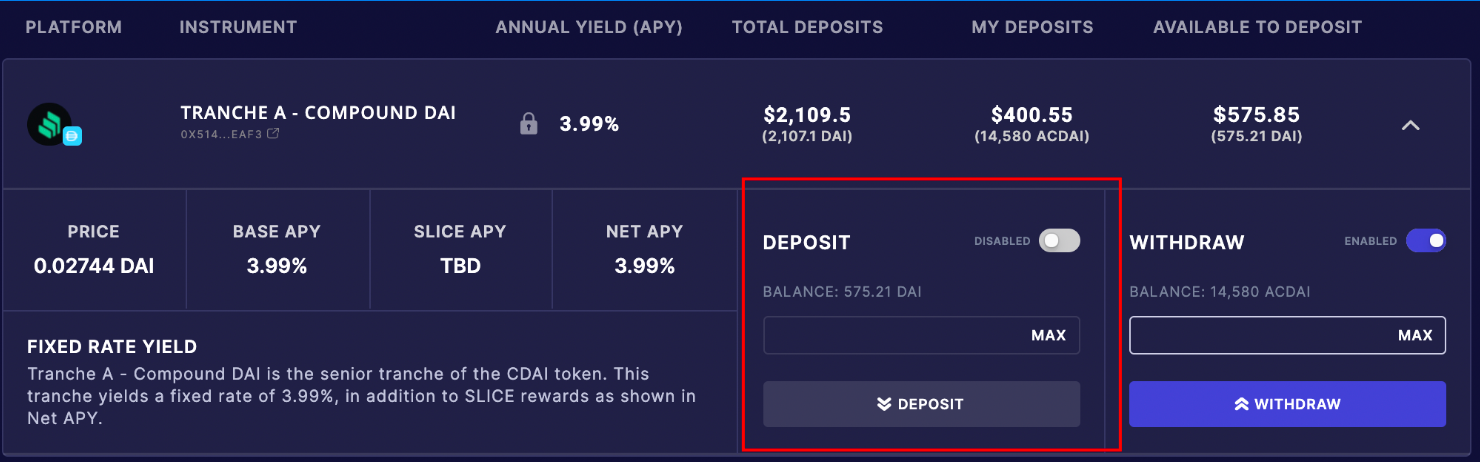

1. To get familiar with every Tranche, grow the crate by squeezing anyplace on the card. You'll see more data on the breakdown of the yield of the resource:

- Net APY: The APY that you will get for becoming tied up with the Tranche, this APY is the mix of the Tranche APY + SLICE APY

- Tranche APY: The APY assigned to the Tranche. On account of Tranche A tokens, this is a decent rate. On account of Tranche B, the APY depends on the measure of Tranche A, Tranche B holders and the Base APY as depicted here.

- Base APY: The base APY is the first rate from the convention, and ought to be utilized for reference as it were.

- SLICE APY: The prizes and motivating forces paid out in SLICE to Tranche An or Tranche B holders, contingent upon the condition of the framework, SLICE rewards are nitty gritty here.

- Price:The conversion scale between the saved resource and the Tranche.

2. To store into and purchase the Tranche token, you really want to initially empower the spend of your resource by pushing on the switch on the upper right badge of the Deposit segment. This activity expects you to acknowledge the exchange spring up on your Ethereum wallet.

3. After you empower stores, input the sum that you might want to buy, and tap the store button. Subsequent to storing, you'll get a comparable measure of your store as Tranche tokens.

4. You can follow the exhibition of your store by really taking a look at the sum under the "My Deposits" segment.

Stake

To guarantee liquidity and boost investment in administration and convention usage, three marking modules were presented - SLICE marking, SLICE-ETH LP marking and SLICE-DAI LP marking. Clients can stake any of the three tokens and get SLICE rewards paid out week after week.

By giving SLICE and ETH or SLICE and DAI on Uniswap, you are giving liquidity to the particular exchanging sets, permitting existing extra members to flawlessly cooperate with environment. Consequently, we are compensating clients who stake SLICE LP tokens.

Step by step instructions to Stake Tutorial

A. Setting up

You really want to have a MetaMask wallet to collaborate with this agreement.

B. Saving:

You can store SLICE or any of the SLICE-LP tokens through the application. Push on the "+" sign on the Staked Token cardPress on the "Endorse" button on the spring up that appearsEnter the sum that you might want to store, and afterward press "Stake"

C. Guaranteeing rewards:

After every age end, you will be distributed a compensation for marking SLICE during that age. You can either guarantee your award each week, or save money on gas charges and do it once you are prepared to pull out.

Go to the SLICE Rewards Accrued card and press "Claim"Select the pool you might want to guarantee the prizes to and click Claim

D. Pulling out remunerations:

You can pull out your assets at some random point. To do as such:

Push on the "- " sign on the Staked Token cardEnter the sum that you might want to pull out, and afterward press "Stake"

What is Staking utilized for?

Tranche's marking modules serve two functionalities:

- SLICE Staking - Backstop Module: in case of convention bankruptcy the marked SLICE goes about as the conventions screen module, forestalling Tranche misfortunes.

- LP Staking - Liquidity Incentivization: To guarantee steady liquidity in Uniswap Pools, LP marking boosting clients to give ETH, Dai and SLICE into Uniswap contracts.

Bitcointalk Username: Sharena Delon

Wallet: 0x34bca8bb2d4dd87d53afb895799258bc2b069d78

Tidak ada komentar:

Posting Komentar