The commodity exchange is a meeting place between demand and supply of commodities and derivatives. The seller and the buyer of commodity goods meet at the exchange. In addition to buyers and sellers, there is also an intermediary trader known as commissioners and brokers. Commissioners take a position in the competitive market of goods, while the realtor can not hold positions on certain commodities that enter into the market of competitors and non-competitors.

Commonly traded commodities are coffee, cocoa, sugar, soybeans, corn, gold, copper, titanium, aluminum, cotton, pepper, wheat, and CPO (crude palm oil, crude palm oil), cotton, milk, , nickel) as well as futures contracts that use commodities as their reference assets.

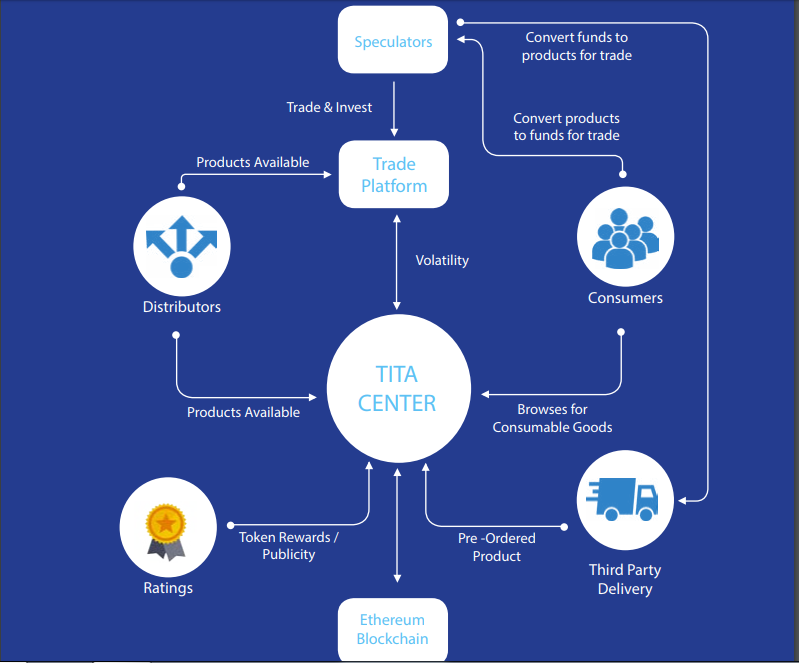

The TITA network is supported by Ethereum Blockchain through the use of Smart contracts. The TITA project creates a decentralized network, its ecosystem drives to Improve the Efficiency of the Supply Chain of finished or unfinished goods, Bridge Asset Investment, diversify risks in commodity markets and provide enhanced financing for production communities.

The TITA Project has a strong value proposition for the Commodities Exchange, the Finished Goods Market, the Manufacturing Organization, the logistics company, the security company providing services for commodity trading, cleaning houses, agents, buyers, and sellers. Thus creating a unique space for our users by creating a multifunctional platform that connects these various players, making trading easier and giving them the ability to access various services.

With a Commodity Market capitalization of over $ 50 trillion, the TITA Network empowers everyone to interact, trade and invest seamlessly in one of the world's largest markets.

BLOCKCHAIN TECHNOLOGY ON COMMODITY TRADING

A Blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the records cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network.

A Blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the records cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network.

Applied correctly, the innovation has the potential to boost commodity prices, open up channels of trade between buyers and sellers that have until now have been perceived as credit risks, and provide more transparency and liquidity to a market that has slowly lost favor among financial institutions. Blockchain can help commodity traders transcend conventional market barriers. It also ensures timely settlement, expedites capital allocation and provides proof of collateral.

Problem

Here, we address some of the basic and pressing challenges of global commodity trade and how it affects the end products that we see today. These are the problems the TITA project is built into provide solutions to.

Here, we address some of the basic and pressing challenges of global commodity trade and how it affects the end products that we see today. These are the problems the TITA project is built into provide solutions to.

- Cash Settlement

The main drawback in cash settlement is that the commodities spot wholesale market is not an organized one (globally). Commodity prices vary from location to location and also in accordance with their quality characteristics, variety and preferred end-uses in different locations.

There is no single unique cash price quotation for a commodity valid throughout the country at any given time. - Credit Lines

Access to international markets becoming more constrained as a result of tighter credit lines of intermediaries in developed markets. - Logistics

Commodity traders know that a typical metals shipment is not just from mine to smelter or refiner to purchaser; rather, it can involve ships, trains, warehouses, and factories along the way. And even when that shipment sits in on a barge or vessel for a month or in a factory for a year, its ownership can change multiple times. - Technology

The commodities markets have been laggards when it comes to innovative and cutting-edge technology. Many commodities traders have invested heavily in their Commodities Trading and Risk Management (CTRM) technology. However, Many companies and individuals are not satisfied that they are unlocking the full benefits of their investment

TITA's ecosystem

Decentralized networks designed to operate like e-commerce markets where Raw Materials and their finished products come into contact with other manufacturers, buyers, sellers, suppliers, distributors and trading agents. This will give users a good product visibility and ensure that high quality standards, transparency, and transaction convenience are met with the use of smart contracts and the power of blockchain technology.

Decentralized networks designed to operate like e-commerce markets where Raw Materials and their finished products come into contact with other manufacturers, buyers, sellers, suppliers, distributors and trading agents. This will give users a good product visibility and ensure that high quality standards, transparency, and transaction convenience are met with the use of smart contracts and the power of blockchain technology.

TITA EXCHANGE

A decentralized commodity trading exchange is designed to provide robust trading services for trading futures contracts. The use of robotic API's is implemented to enable automatic and semi-automatic trade execu- tions for users.

A decentralized commodity trading exchange is designed to provide robust trading services for trading futures contracts. The use of robotic API's is implemented to enable automatic and semi-automatic trade execu- tions for users.

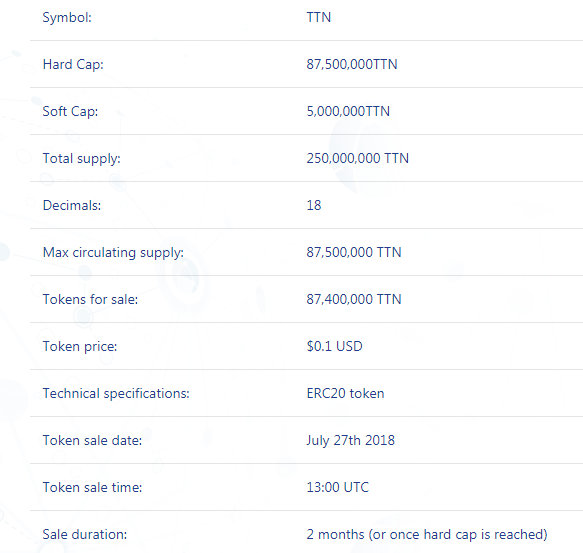

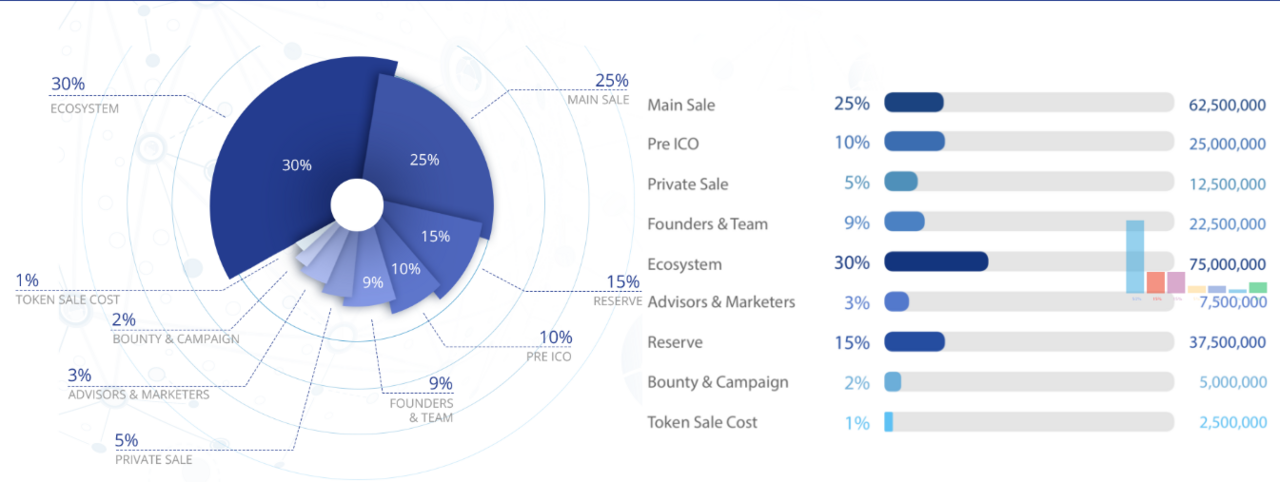

TOKEN DETAIL

Author (Beat Putih) ; https://bitcointalk.org/index.php?action=profile;u=1953434

Tidak ada komentar:

Posting Komentar